Important Ideas

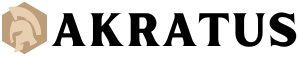

- Ayvens key company owners suggest that important decisions are influenced by shareholders from the wider community.

- The main shareholder of the company is Société Générale Société Anonyme with a share of 53%

- 11% of Ayvens is held by Institutions

A look at the shareholders of Ayvens (EPA:AYV) can tell us which group is the strongest. With a share of 53%, public companies have the most shares in the company. That is, the group will benefit the most if the stock goes up (or lose the most if there is a drop).

Individual investors, on the other hand, account for 19% of the company’s stock.

Let’s take a closer look to see what different types of shareholders can tell us about Ayvens.

Check out our latest review for Ayvens

What Are Institutional Owners Telling Us About Ayvens?

Institutional investors often compare their returns to the returns of a commonly tracked index. So they generally consider buying larger companies that are included in the relevant benchmark index.

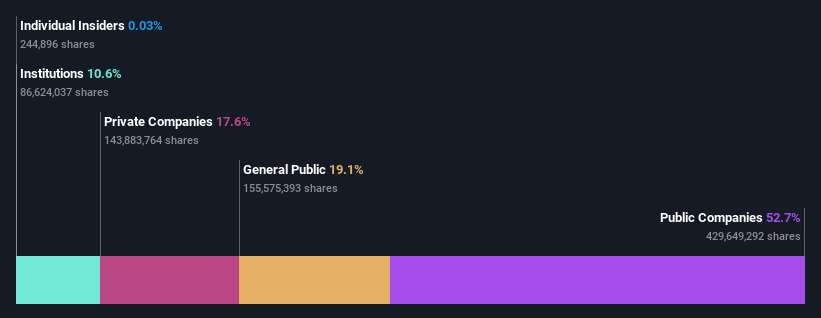

Ayvens already has registered units. Indeed, they have a respectable role in the company. This can show that the company has a certain degree of credibility in the investment community. However, it is better to be careful about relying on the evidence that is said to come with institutional investors. They, too, make mistakes sometimes. It is unusual to see a large drop in the share price if two institutional investors try to sell at the same time. So it’s worth checking out Ayvens’ past earnings, (below). Of course, remember that there are other factors to consider as well.

Hedge funds do not hold many shares in Ayvens. Société Générale Société anonyme is the largest shareholder, with 53% of the outstanding shares. This means they have significant influence, if not direct control, over the future of the organization. In comparison, the second and third largest shareholders hold approximately 9.5% and 8.1% of the stock.

Researching institutional ownership is a good way to measure and filter the expected performance of a stock. The same can be achieved by studying the opinions of critics. Several analysts cover the stock, so you can easily check the growth forecast.

Inside the Ayvens Owners

Although the correct definition of an insider can be important, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is common for directors to be members of the executive board, especially if they are the founder or CEO.

Insider ownership is great when it shows that leadership thinks like the real owners of the company. However, elite insider owners can also give great power to a small group within the company. This can be bad in some cases.

Our data suggests that insiders own less than 1% of Ayvens by name. However, we note, it is possible for insiders to have an indirect interest in a private company or other business structure. It is a very large company, so it is possible for board members to have a significant interest in the company, without having an equal interest. In this case, they have about 1.5 million shares of stock (at current prices). It’s always good to see at least some insider ownership, but it can be useful to check if those insiders are still selling.

Public Authority in General

The general public, who are mostly individual investors, have a 19% stake in Ayvens. This majority of owners, even if it is a majority, may not be enough to change the company’s policy if the decision is not agreed with the other major shareholders.

Ownership of a Private Company

We see that Private Companies have 18% of the shares in question. It is difficult to draw conclusions from this point alone, therefore, it is important to look at who owns those private companies. Sometimes insiders or other related parties have an interest in shares of a public company through a private limited company.

Public Company Authority

It appears to us that public companies own 53% of Ayvens. It’s hard to tell the truth but this suggests that they have combined business interests. This may be an important part, so it is important to watch this site for personal changes.

Next Steps:

Although it is good to think about the different groups that have a company, there are other factors that are more important. Like accidents, for example. Every company has them, and we’ve seen them 3 warning signs for Ayvens (which 1 relate to a bit!) you should know about.

If you’re like me, you might want to think about whether this company will grow or shrink. Fortunately, you can check out this free report that shows analyst predictions for its future.

NB: The figures in this article are calculated using data for the last twelve months, which refers to the 12 month period ending on the last day of the month the financial statement is written. This may contradict the figures in the full year report.

New: Manage all your stock portfolios in one place

We made the ultimate portfolio partner for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Alerting of New Warning Signs or Hazards by email or phone

• Track the Quality of your goods

Try Demo Portfolio for free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are not sensitive to pricing or quality materials. Simply Wall St has no position in the stocks mentioned.

Have a comment about this article? Are you concerned about the news? Contact us directly. Alternatively, email editorial-team@simplywallst.com

#individual #investors #Ayvens #EPAAYV #public #companies #largest #shareholders #ownership