Investors in The Interpublic Group of Companies, Inc. (NYSE: IPG) had a good week, as its shares rose 4.5% to close at US$30.98 after the release of quarterly results. Revenues were US$2.3b, roughly in line with expectations, although statutory earnings per share (EPS) performed well. EPS of US$0.57 was also better than expected, beating analyst estimates by 12%. Analysts often update their estimates at each earnings report, and we can judge from their estimates whether their view of the company has changed or whether there are new concerns. them. Readers will be pleased to know that we have compiled the latest official estimates to see if analysts have changed their views on Interpublic Group of Companies after the latest results.

Check out our latest analysis for the Interpublic Group of Companies

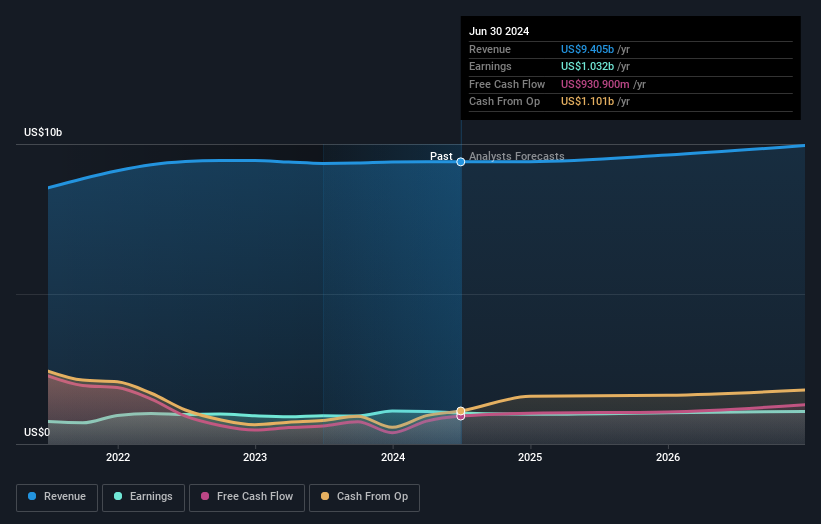

After last week’s earnings report, eight analysts at Interpublic Group of Companies forecast 2024 revenue to be US$9.41b, roughly in line with the previous 12 months. Statutory earnings per share are estimated to fall by 4.5% to US$2.62 over the same period. However before the latest earnings, analysts were expecting revenue to reach US$9.43b and earnings per share (EPS) of US$2.64 in 2024. So it is clear that, although analysts updated their forecasts, there has been no significant change in business expectations based on recent results.

It is not surprising then, to know that the target price of the agreement is not much changed at US $ 33.96. However, there is another way to think about price targets, and that is to look at the range of price targets set by analysts, because different estimates can give different opinions about the results. potential for business. Currently, the most influential analyst values Interpublic Group of Companies at US$39.00 per share, while the lowest price target is US$28.00. There are certainly different opinions about the stock, but the range of estimates is not wide enough to suggest that the situation is unpredictable, in our opinion.

One way to get more meaning about these forecasts is to look at how they compare to past performance, and how other companies in the same industry are doing. It is clear that there is an expectation that the revenue growth of Interpublic Group of Companies will slow down significantly, and the earnings until the end of 2024 are expected to show a growth of 0.1% annually. This compares to a historical growth rate of 3.0% over the past five years. Compare this against other companies (by analyst estimates) in the industry, which are generally expected to see revenue growth of 3.4% annually. So it is clear that, while revenue growth is expected to slow, the broader industry is also expected to grow faster than the Interpublic Group of Companies.

The Bottom Line

The obvious conclusion is that there has not been a major change in business expectations in recent times, while analysts have held their earnings estimates steady, based on previous estimates. On the bright side, there were no major changes in revenue estimates; although it is predicted that they will perform worse than the wider industry. There was no real change in the consensus price target, suggesting that the intrinsic value of the business has not undergone significant changes in recent estimates.

That being said, the company’s long-term earnings path is more important than next year. We have forecasts – from many analysts of the Interpublic Group of Companies – from 2026, and you can see them for free on our platform here.

You can also see if Interpublic Group of Companies is heavily indebted, and if its balance is healthy, for free on our platform here.

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are not sensitive to pricing or quality materials. Simply Wall St has no position in the stocks mentioned.

Have a comment about this article? Are you concerned about the news? Contact us directly. Alternatively, email editorial-team@simplywallst.com

#Results #Interpublic #Group #Companies #Exceeded #Expectations #Consensus #Raised #Estimates