Amid fluctuating market conditions and escalating trade tensions, the German stock market has undergone significant changes, reflecting broader challenges for the European economy. In this context, examining growth companies such as Brockhaus Technologies with high ownership inside the German exchange can provide interesting information about stability and long-term value in turbulent times.

Top 10 Growth Companies with Insider Ownership in Germany

|

Name |

Insider Ownership |

Income Growth |

|

pferdewetten.de (XTRA:EMH) |

26.8% |

75.4% |

|

German Equity (XTRA:DBAN) |

39.3% |

34.7% |

|

YOC (XTRA:YOC) |

24.8% |

21.8% |

|

NAGA Group (XTRA:N4G) |

14.1% |

78.3% |

|

Exasol (XTRA:EXL) |

25.3% |

105.4% |

|

Allion Energy Systems (DB:2FZ) |

37.4% |

106.6% |

|

Stratec (XTRA:SBS) |

30.9% |

21.9% |

|

elumeo (XTRA:ELB) |

25.8% |

99.1% |

|

Redcare Pharmacy (XTRA:RDC) |

17.7% |

47.4% |

|

Friedrich Vorwerk Group (XTRA:VH2) |

18% |

30.4% |

Click here to see the full list of 18 stocks from our German Fast-Growing Companies with High Authority Insider screener.

We will review the selection from our review results.

Wall St Growth Status Simply: ★★★★☆☆

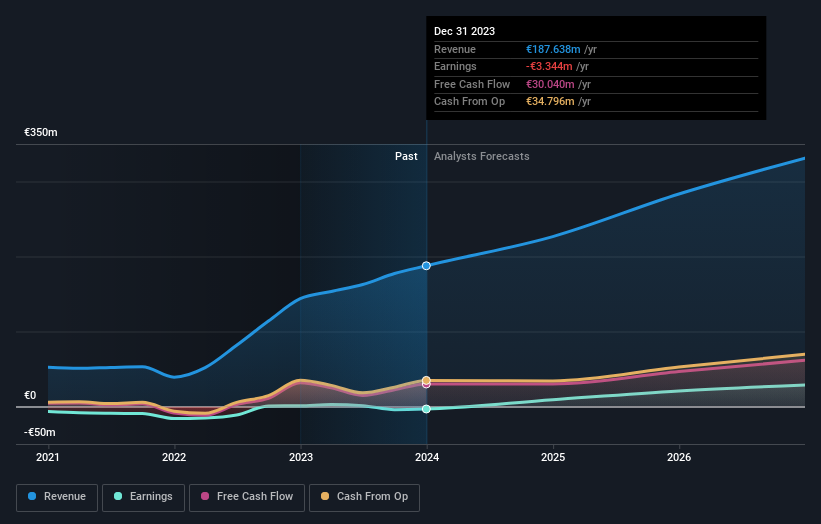

Summary: Brockhaus Technologies AG operates as a private equity firm and has a market capitalization of approximately 316.56 million.

Operation: Brockhaus Technologies AG generates its income mainly in two areas: Security Technologies, which brought in €39.43 million, and Financial Technologies, which contributed €153.43 million.

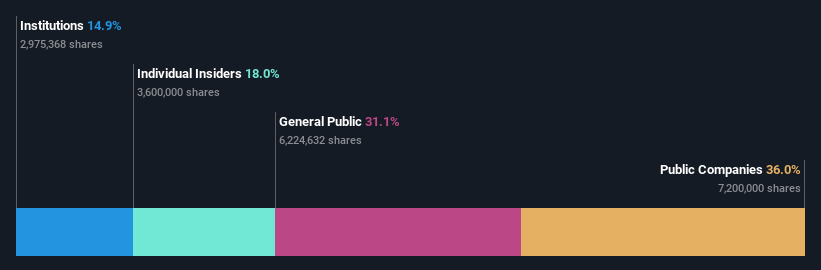

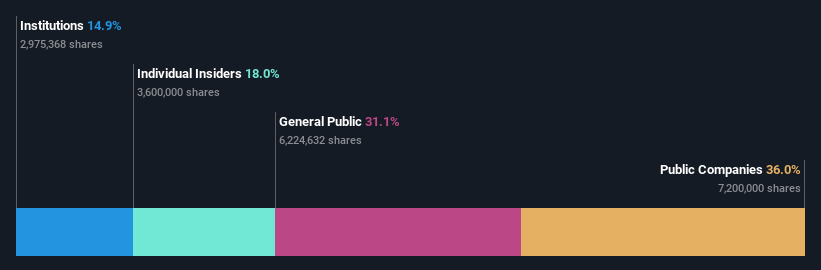

Internal control: 26.6%

Brockhaus Technologies, a growth company in Germany, showed a significant increase in revenue with 39.97 million euros recorded in Q1 2024, from € 33.89 million last year. Despite this growth and estimates showing a 17.8% increase in annual revenue, the firm posted a net loss of 1.38 million euros, up from 0.488 million the year before . The expected profit during the three years and the business at 75.8% below the estimated value highlights the potential situation, however a low relative return on equity (10.3%) is still expected.

Wall St Growth Status Simply: ★★★★☆☆

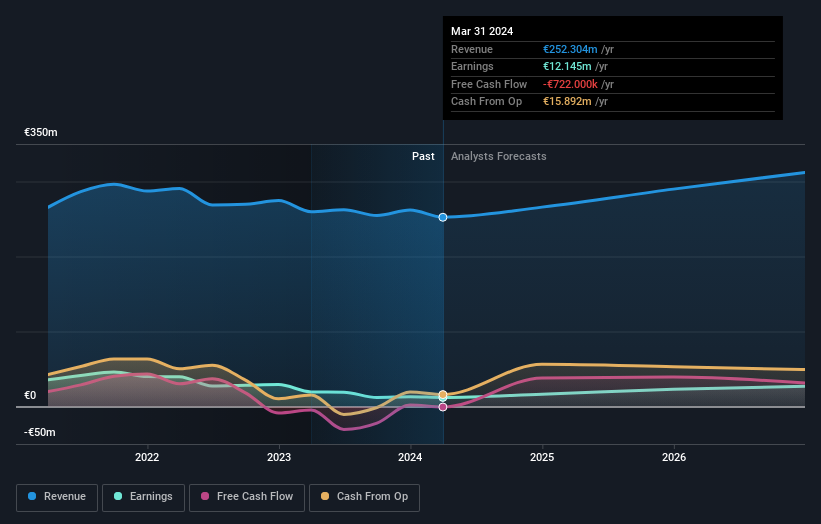

Summary: Stratec SE operates in Germany and internationally, designing and manufacturing automation solutions and equipment for in vitro testing and life sciences, with a market of approximately 0.50 billion.

Operation: The company generates its revenue by designing and manufacturing automation solutions and equipment for in vitro testing and life sciences sectors across Germany, the European Union and other global markets.

Internal control: 30.9%

Stratec, a German growth company, has a forecasted earnings growth of 21.9% annually, which exceeds the market average. However, its revenue growth of 7.8% lagged behind the top 20% growth figure. Recent presentations at industry conferences highlight its active commitment to the sector, although its Q1 results showed a drop in sales and revenue compared to last year. The business’s 49.2% below valuation suggests a potential undervalue amid challenges such as low profit margins and moderate return on equity (11%).

Wall St Growth Status Simply: ★★★★☆☆

Summary: Friedrich Vorwerk Group SE works hard to solve problems of change and transfer energy throughout Germany and Europe, with a market capitalization of about €0.37 billion.

Operation: The company’s revenue is generated in sectors focused on electricity (€ 72.07 million), natural gas (€ 157.60 million), pure hydrogen (€ 28.59 million), and nearby opportunities (€ 118.73 million).

Internal control: 18%

Friedrich Vorwerk Group SE, a German growth company, has reported a solid increase in first quarter sales and net income for 2024. Despite its forecast for moderate revenue growth of 8.3% in year, which is above the German market average but below the high growth rates. , earnings are expected to rise 30.45% annually over the next three years. The company’s return on equity is expected to remain low at 11%. No significant business activity has been reported recently.

Take Advantage

Want to know about other options?

This Simply Wall St article is general in nature. We provide opinions based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not include recent company announcements that are not sensitive to pricing or quality equipment. Simply Wall St does not have a position in any of the stocks mentioned. The analysis only considers stocks held directly by insiders. It does not include indirect property holdings in other vehicles such as corporations and/or trusts. All revenue estimates and earnings growth estimates quoted are at annual (annual) growth rates over a 1-3 year period.

Companies discussed in this article include XTRA:BKHT XTRA:SBS and XTRA:VH2.

Have a comment about this article? Are you concerned about the news? Contact us directly. Alternatively, email editorial-team@simplywallst.com

#Brockhaus #Technologies #top #growth #companies #insider #ownership #German #stock #exchange