To find more stock-baggers, which of the following should we look for in a business? Basically, the business will show two ways; first is to grow up come back on capital employed (ROCE) and secondly, increase money of money spent. Essentially this means that the company has profitable ventures that it can continue to invest in, which is characteristic of a conglomerate. With that in mind, we’ve identified promising trends Interpublic Group of Companies (NYSE:IPG) so let’s take a deeper look.

Understanding Return On Capital Employed (ROCE)

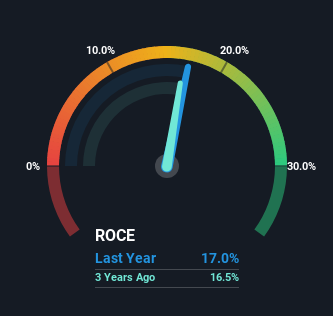

Just to clarify if you’re not sure, ROCE is a metric that measures how much pre-tax income (in percentage) a company earns on the money invested in its business. The formula for these numbers in the Interpublic Group of Companies is:

Return on Capital Employed = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

0.17 = US$1.5b ÷ (US$17b – US$8.3b) (Based on the next twelve months to June 2024).

As a result, Interpublic Group of Companies has a ROCE of 17%. In absolute terms, it is a satisfactory return, but compared to the Media industry average of 10% it is very good.

Check out our latest analysis for the Interpublic Group of Companies

In the chart above we have measured Interpublic Group of Companies’ first ROCE against its past performance, but the future is more important. If you would like to see what analysts are predicting, you should check out our free analyst report for Interpublic Group of Companies.

The ROCE Method

Interpublic Group of Companies is showing promise given that its ROCE is moving up and to the right. Notably, while the company has kept net income relatively flat over the past five years, ROCE has risen 36% over the same period. So there is a chance that the business is now reaping the full benefits of its previous investment, since the capital employed has not changed much. On the other hand, things are looking good, so it’s worth checking out what management has to say about growth plans going forward.

On the other hand, the liabilities of the Interpublic Group of Companies are still high at 49% of the total assets. This can cause some risks because in fact the company works with great confidence in its suppliers or other types of short-term loans. Although it is not a bad thing, it can be good if this ratio is low.

Key Point About Interpublic Group of Companies’ ROCE

To put it all together, the Interpublic Group of Companies has done well to increase the returns it generates from capital employed. And with a respectable 74% given to those who held the stock in the last five years, you could argue that this development is starting to get the attention it deserves. Therefore, we think it will be your turn to check if these trends will continue.

Although the Interpublic Group of Companies looks attractive, no company has a fixed price. Intrinsic value infographic for IPG helps to see if it is currently trading at the right price.

Although the Interpublic Group of Companies doesn’t make a lot of money, check this out for free list of companies with the highest earnings per balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High Growth Tech and AI Companies

Or create your own from over 50 metrics.

Learn Now for Free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are not sensitive to pricing or quality materials. Simply Wall St has no position in the stocks mentioned.

Have a comment about this article? Are you concerned about the news? Contact us directly. Alternatively, email editorial-team@simplywallst.com

#Interpublic #Group #Companies #NYSEIPG #MultiBagger #Deal