Important Notes

-

Private companies Kossan Rubber Industries Bhd suggests that important decisions are influenced by shareholders from the wider community.

-

A total of 5 investors have majority stake in the company with 52% ownership.

-

The share price in Kossan Rubber Industries Bhd is 14%.

If you want to know who really controls Kossan Rubber Industries Bhd (KLSE:KOSSAN), then you will have to look at its share registration structure. And the group that holds the largest share of the pie is private companies with 36% ownership. Put another way, the team faces the highest potential (or the lowest risk).

While institutions with 26% came under pressure after the market dropped to RM6.2b last week, private companies suffered the most.

In the chart below, we zoom in on the different ownership groups of Kossan Rubber Industries Bhd.

Get a full review of the name Kossan Rubber Industries Bhd

What Does the Institutional Valuation Tell Us About Kossan Rubber Industries Bhd?

Institutional investors often compare their returns to the returns of a commonly tracked index. So they generally consider buying larger companies that are included in the relevant benchmark index.

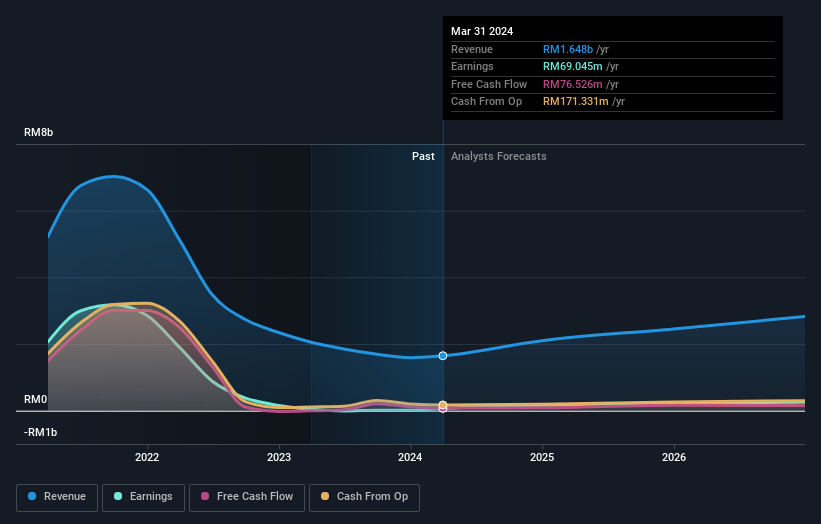

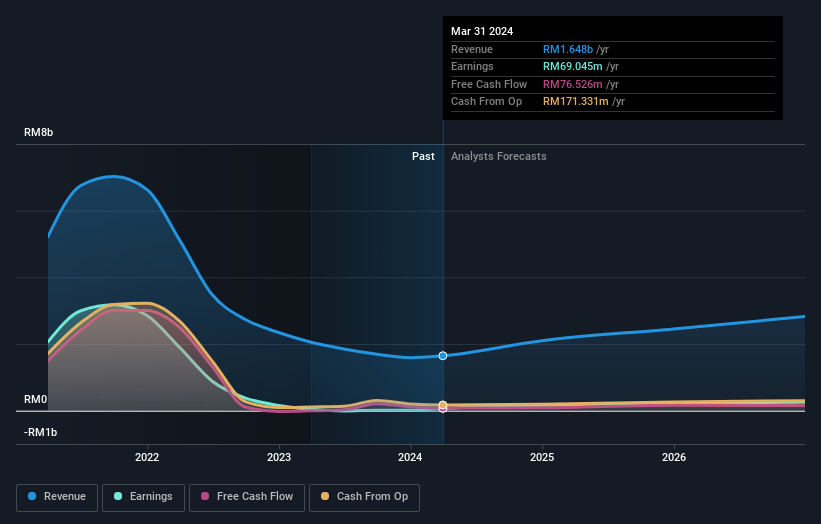

Kossan Rubber Industries Bhd already has registered offices. Indeed, they have a respectable role in the company. This means that the analysts who work for those institutions are looking at the stock and they like it. But like everyone else, they can make mistakes. If many institutions change their views on a stock at the same time, you can see the share price drop rapidly. Therefore, it is important to look at Kossan Rubber Industries Bhd’s financial history below. Of course, the future is what really matters.

Kossan Rubber Industries Bhd does not own any hedge funds. Our data shows that Kossan Holdings (M) Sdn Bhd is the largest shareholder with 35% of outstanding shares. With 5.5% and 5.3% of outstanding shares respectively, Employees Provident Fund of Malaysia and abrdn plc are the second and third largest shareholders. In addition, the company’s CEO Kuang Sia Lim directly holds 2.7% of the total outstanding shares.

To make our study even more interesting, we found that the top 5 owners control more than half of the company, which means that this group has a lot of power over the company’s decisions.

While it makes sense to study the company’s personal data, it makes sense to study the opinions of analysts to know which way the wind is blowing. There are many analysts who deal with the stock, so it would be useful to get their general opinion about the future.

The low price of Kossan Rubber Industries Bhd

Although the correct definition of an insider can be important, almost everyone considers board members to be insiders. The management of the company runs the business, but the CEO will answer to the board, even if he is a member of it.

I generally consider insider ownership to be a good thing. However, sometimes it is difficult for others to hold the board accountable for decisions.

Our information suggests that insiders hold a lot of money in Kossan Rubber Industries Bhd. It has a market capitalization of only RM6.2b, and insiders have valuable shares worth RM876m to their name. That is very important. It is good to see this level of investment. You can check here to see if insiders are buying recently.

Public Authority in General

With 23% ownership, the general public, mainly made up of individual investors, have a certain degree of control over Kossan Rubber Industries Bhd. Although this team won’t be able to call the shots, it can certainly have a real impact on how the company is doing. run.

Ownership of a Private Company

We see that Private Companies have 36% of the outstanding shares. It would be good to look into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

I find it very interesting to look at who actually owns the company. But to truly gain insight, we need to consider some factors as well. Example: We saw 2 warning signs for Kossan Rubber Industries Bhd you should be aware, and 1 of them don’t sit well with us.

But in the end it is the future, not in the past, will show how well the owners of this business will perform. So we think it’s wise to check out this free report that shows what analysts are predicting a bright future.

NB: The figures in this article are calculated using data for the last twelve months, which refers to the 12 month period ending on the last day of the month the financial statement is written. This may contradict the figures in the full year report.

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide opinions based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not include recent company announcements that are not sensitive to pricing or quality equipment. Simply Wall St has no position in the stocks mentioned.

Have a comment about this article? Are you concerned about the news? Contact us directly. Alternatively, email editorial-team@simplywallst.com

#Private #equity #firms #disappointed #institutions #Kossan #Rubber #Industries #Bhds #KLSEKOSSAN #market #cap #dropped #RM357m