LThe 60 largest public companies performed well on Wall Street last year, but also on Main Street.

These 60 companies as a whole managed to hold their own for market performance, posting a 20% jump in market capitalization last year to $737 billion, according to market data analysis for of the Business Journal’s annual list. That was slightly below the 26% gain for the Standard & Poor’s 500 index and the 25% increase in the broader Russell 3000 index; these two are the most similar combination of companies in the Business Journal list.

The increase in income was much easier. In total, 60 companies posted a profit of 7.3% of revenue last year to approximately $307 billion.

But net income, which measures profits, fell last year by $5.45 billion, or 25%, to $16.5 billion. Over half (31) of the 60 companies saw revenue decline in 2023 compared to 2022, including several that reported larger losses than last year.

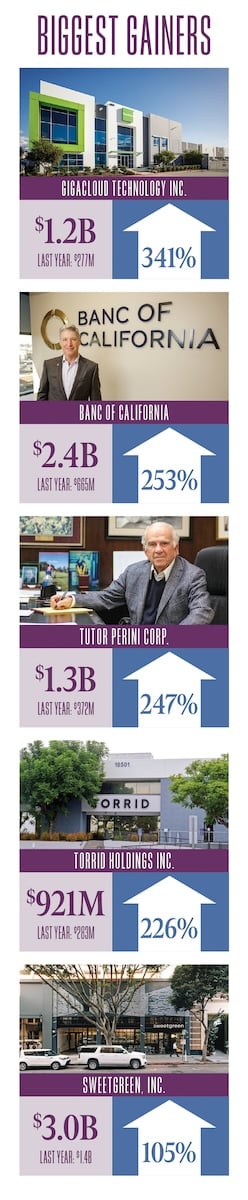

No company exemplifies this decentralized process more than Century City-based Banc of California, Inc. This small bank was the second-biggest market-gainer on the list, jumping 253% to $2.35 billion. But it saw a 79% drop in revenue last year to $278 million, as it continued to post a loss last year of nearly $1.9 billion as the bank struggled with non-performing loans.

It is true that the times were slightly different (June 30 last year to July 15 this year for the market and calendar year 2022 to 2023 for financial metrics), but it was still instead of six months.

Last year in November, the bank met with PacWest Bancorp and finances have always been stable; The bank holding company last week reported second quarter revenue of $20.4 million, while revenue for the first half of this year increased to $41 million.

Returning to the Business Journal market list, 43 of the 60 companies on the list posted a profit between June 30 of last year and July 15 of this year, the period analyzed in this year’s Business Journal list. .

The richest person in dollars was a biotech giant Amgen Corporation Inc. (up to $58 billion to $177 billion), The Walt Disney Co. (up to $24 billion to $187 billion) and a private equity firm Ares Management Corp. (up to $9 billion to $26 billion). Amgen’s gain was partly due to government regulators finally approving its takeover of an Irish pharmaceutical company. Horizon Therapeutics.

In terms of percentage, the highest earners were GigaCloud Technology Inc. (up 341% to $1.22 billion), Banc of California (up 253%) and Tutor Group Perini Corp. (up to 247%).

The market’s biggest losers in dollars were biotech firms Acelyrin Inc. (less than $ 1.42 billion), sports producer Mattel Group Inc. (less than $1.18 billion) and List of Kennedy-Wilson Holdings Inc. (down $993 million).

Acelyrin was also the biggest loser, losing 70% of its market share. In September, the Agoura Hills-based biotech firm announced that its lead drug to treat skin diseases failed to produce positive results in a recent clinical trial.

Other big percentage losses were Kennedy-Wilson and Fulgent Genetics Inc. Share Details (down 44% and 43% respectively).

On the revenue front, 43 of the 60 companies on the Business Journal list reported revenue gains, led by a jump of $6.18 billion. The Walt Disney Co. and $ 6.07 billion to Shares of Live Nation Entertainment Inc.

Banc of California’s revenue of $1.06 billion was the largest, followed by Edison International (down $882 million) and Marcus & Millichap Group Inc. (down $681 million).

In percentage terms, Banc of California had the largest decline in revenue, followed by Fulgent Genetics and Marcus & Millichap, both down 53%.

Last year, 17 out of 60 companies lost money. Also, after Banc of California, Snap Inc. posted the biggest loss of $1.32 billion, followed by Lions Gate Entertainment Corp. with a loss of 1.1 billion dollars).

Two companies, which were previously on the list, did not qualify this year.

Last year Microsoft Corp. bought it List of shares of Activision Blizzard Inc. for $ 69 billion. Activision, based in Santa Monica, is one of the largest video game studios in the world. Its titles include “Call of Duty” and “World of Warcraft” and it has many small studios in the area. Last year, it ranked No. 3 with a market capitalization of $65 billion.

It is a legal and technical management company LegalZoom.com Inc. in April it became the latest company to leave Los Angeles County, taking its market capitalization to $1.26 billion. After calling Glendale home since 2010, the company moved its headquarters to Mountain View while maintaining local operations. It was founded in 2001 by, among others, a lawyer Robert Shapiro – a key member of OJ Simpson’s “Dream Team” of security consultants. LegalZoom was the No. 1 company. 35 on last year’s list, with a market capitalization of $2.4 billion.

#Public #Company #Profile #Market #Rises #Earnings #Fall